Table Of Content

- NCLH Price Targets by Month

- Investing in Cruise Stocks in 2020

- Analysts' Consensus Price Target

- First Images Of Helldivers 2 s Illuminate Alien Enemies Emerge

- Norwegian Cruise Line (NCLH) Stock Forecast & Price Target

- Last Night’s Attacks on Iran Just Set the Stage for a Stock Market Crash

- How we use your personal data

All of those numbers are only expected to increase from here, with much stronger demand. Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits. Norwegian Cruise Line Holdings Ltd., together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. The company operates through the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. If you buy and hold Norwegian Cruise Line stock, the expectation is over time the near-term fluctuations will cancel out, and the long-term positive trend will favor you - at least if the company is otherwise strong.

NCLH Price Targets by Month

One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. The limitation of this approach is that some companies are quite different from others, even within the same industry classification. As is clear from the image below, Norwegian Cruise Line Holdings has a better ROE than the average (17%) in the Hospitality industry. Plus, with growing demand, the company just ordered eight new ships, which is the biggest order in company history. “We expect these strategic investments will secure our growth trajectory, significantly boost our earnings profile, and enhance shareholder value well into the future,” added Chief Financial Officer Mark Kempa. Cruise bookings are hitting record highs, creating big opportunity for some of the top cruise stocks to buy now.

Why Norwegian Cruise Line Stock Dropped 11% Last Month - The Motley Fool

Why Norwegian Cruise Line Stock Dropped 11% Last Month.

Posted: Mon, 05 Feb 2024 08:00:00 GMT [source]

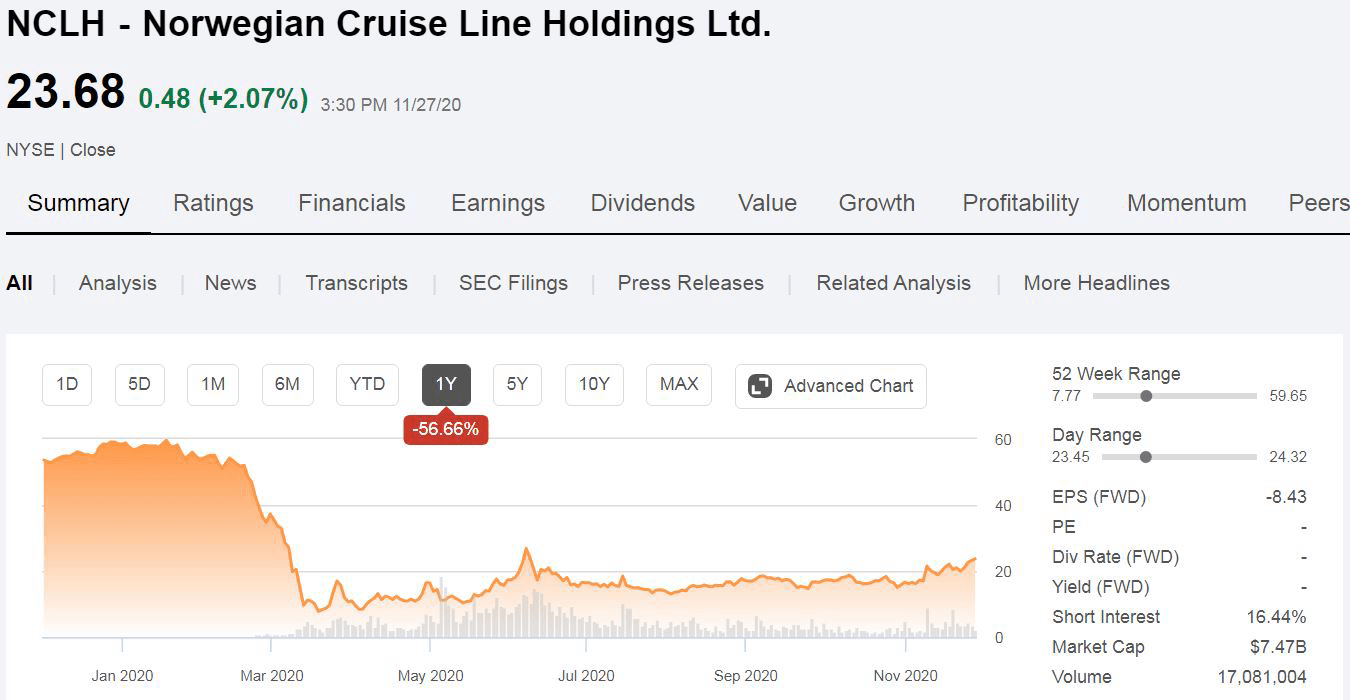

Investing in Cruise Stocks in 2020

Cruise stocks rallied in intraday trading Tuesday after a strong earnings report and forecast from Norwegian Cruise Line Holdings (NCLH). Norwegian Cruise Line (NCLH) rises on 4Q revenue and 1Q upbeat guidance. NCLH's incredibly strong results highlight the strength in its brand and the cruise industry, notes Ivan Feinseth. According to 15 analysts, the average rating for NCLH stock is "Hold." The 12-month stock price forecast is $20.07, which is an increase of 9.73% from the latest price. Royal Caribbean also just raised its annual adjusted earnings per share to a new range of $9.90 to $10.10 for a prior range of $9.50 to $9.70.

Analysts' Consensus Price Target

NCLH Stock Quote Price and Forecast - CNN

NCLH Stock Quote Price and Forecast.

Posted: Wed, 15 Nov 2023 01:22:51 GMT [source]

Jenny Horne explains Norwegian's big plans for the next decade. From new ships to its private Caribbean island, get the latest details in this 1-minute breakdown of Norwegian Cruise Line (NCLH). Big gains might come from the smallest of the country's three leading cruise line operators. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

First Images Of Helldivers 2 s Illuminate Alien Enemies Emerge

A company that can achieve a high return on equity without debt could be considered a high quality business. If two companies have the same ROE, then I would generally prefer the one with less debt. Now while cruise stocks have moved considerably over the last year, 2020 has also created many pricing discontinuities which can offer attractive trading opportunities.

Weakness in consumer spending spurred by an economic downturn could affect discretionary spending, leading pricing to soften and lower onboard spending. Please log in to your account or sign up in order to add this asset to your watchlist. Upgrade to MarketBeat All Access to add more stocks to your watchlist. Sign-up to receive the latest news and ratings for NCLH and its competitors with MarketBeat's FREE daily newsletter.

For the year, the company is expecting earnings before interest, taxes, depreciation, and amortization (EBITDA) of $2.2 billion, a strong 18% increase from 2023. Revenue was ahead of guidance, whereas its net loss was a little more than expected. Try the Trefis machine learning engine above to see for yourself how Norwegian Cruise Line stock is likely to behave after any specific gain or loss over a period. Operating a successful cruise requires significant planning and resources, but these three companies have managed to take over 80% of the $30 billion market. Even though cruise line stocks are going through rough waters, there are reasons to be optimistic.

Company Profile

The company expects an adjusted loss in its upcoming quarter, casting a shadow over several positive developments with the business. As Norwegian is smaller than its North American cruise peers, it has the ability to deploy its assets nimbly as cruising demand rises, allowing for strategic pricing tactics. While the stock is slightly overbought at an all-time high, it could push even higher with demand showing no signs of slowing. This dilution could have a mild adverse impact on Norwegian stock. But the business is otherwise performing quite well, which should be encouraging news for shareholders. In 2023, the company had net cash from operating activities of $2 billion and repaid $1.9 billion in debt.

Those are the big-picture trends that are meaningful to Norwegian's business. And because the trends are good, the company is guiding for better-than-expected financial results in the upcoming first quarter of 2024. Norwegian Cruise Line (NCLH) posted its fourth-quarter results revealing a quarterly loss of $0.18 per share.

While Norwegian Cruise Line currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys. On its current trajectory, it will be able to meet its financial needs although it won't be without some dilution to shareholders. Some of its debt will convert to shares because of how it was arranged. All of the cruise-ship companies incurred significant debt during the worst of the COVID-19 pandemic, including Norwegian.

The 'return' is the income the business earned over the last year. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.55 in profit. MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... Specifically, Norwegian is calling for Q1 adjusted net income of $50 million, while Wall Street had expected an adjusted net loss.

Coronavirus-induced changes in consumer behavior with regard to travel had altered the economic performance of Norwegian Cruise Line Holdings, affecting its ability to generate excess economic rents. However, as consumers returned to cruising after the 15-month sailing halt that ended in July 2021, they regained their appetite for travel, bolstered by the value proposition the holiday provides. With ships fully deployed at historical occupancy levels, pricing surpassed prepandemic levels in 2023, and pricing momentum has persisted into 2024. While Norwegian could intermittently see pricing competition in periods of macroeconomic distress, we believe its freestyle offering and attractive itineraries will keep passengers engaged with the brand. On the cost side, while higher oil prices and unfavorable foreign exchange could elevate costs at times, we expect management will focus on extracting further efficiencies as the business continues to scale. Over time, we expect both pricing and costs to normalize at low-single-digit rates.

No comments:

Post a Comment